Situation

Members look to the Bank for competitive auto loans in a member facing experience.

Timebox

The car loan application was a six month project spanning two Program Increments (12 sprints).

Problem

- Members do not routinely purchase vehicles and are confused by the process

- Members do not understand financial jargon and processes

- The loan application flow was disjointed from periodic, uncoordinated updates without considering the wholistic user experience

- Content updates are difficult and time consuming due to legacy technology

- Legacy technology stack did not leverage the brand design system

- Customer service is difficult because Bank Employees see different screens than a User.

Task

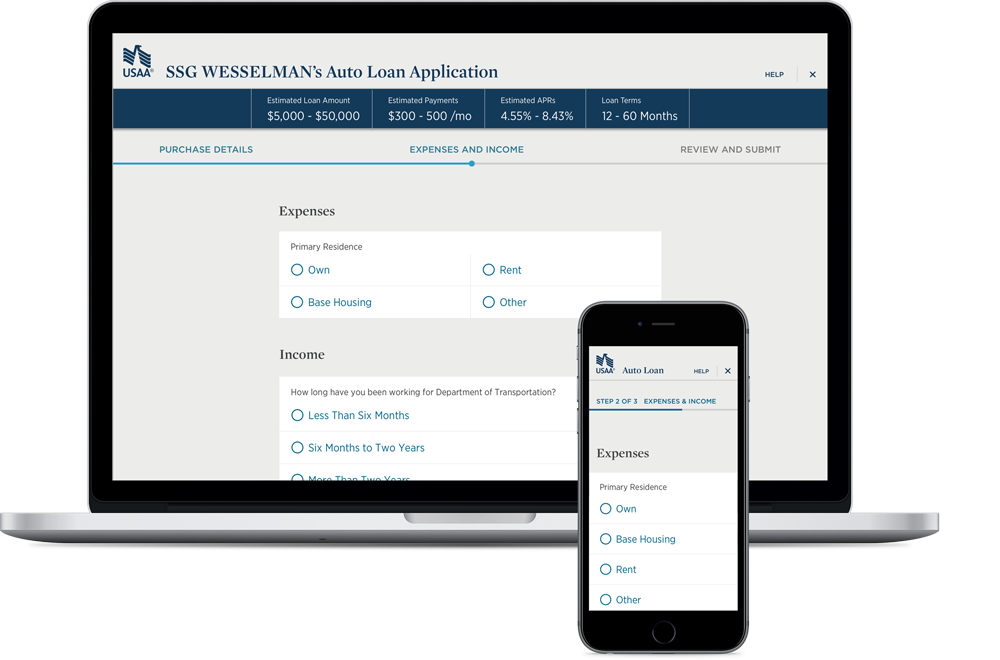

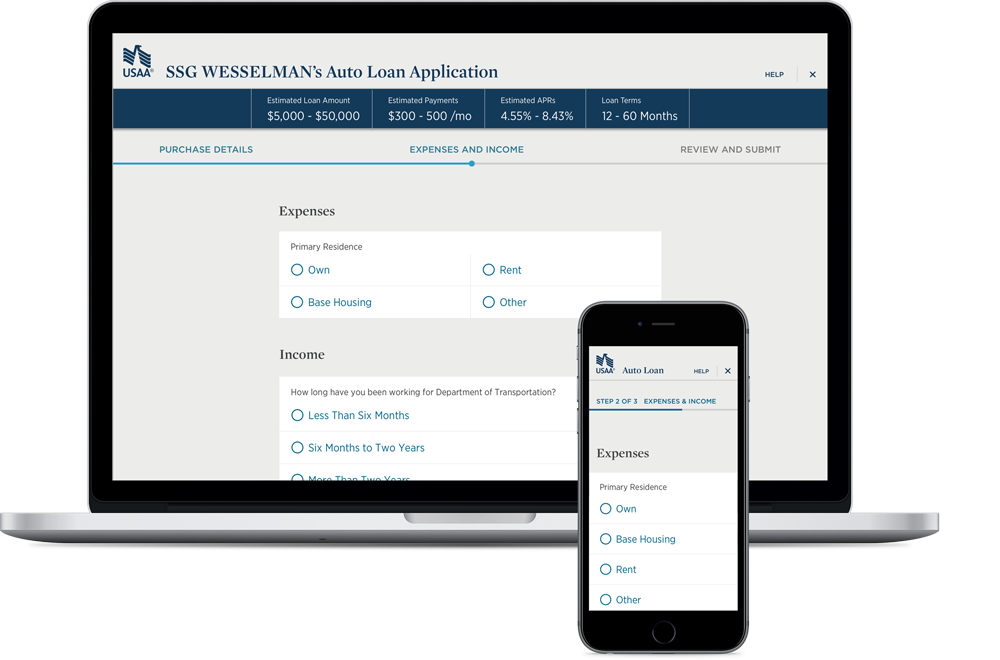

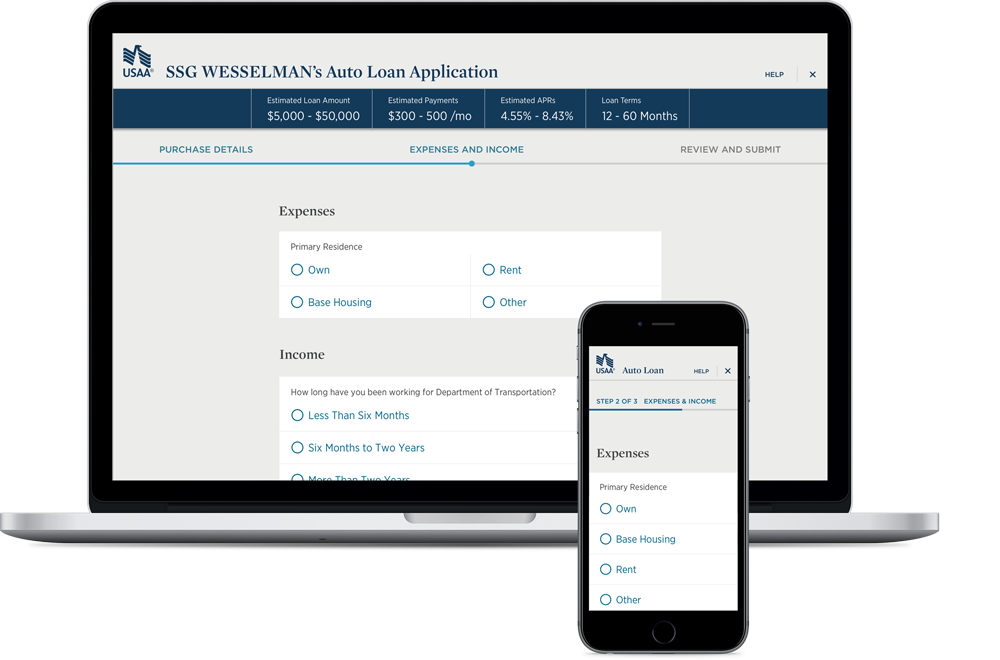

- Bring the car loan application into compliance with the Design System using current technology stack.

- Create educational opportunities to increase user understanding in the process.

- Organize the car loan application for user comprehension and confidence

- Bring the car loan application into compliance with the brand Design System

Action

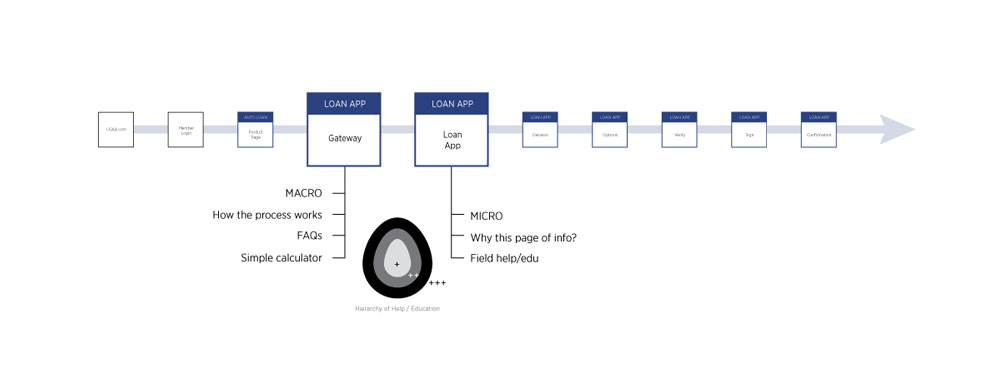

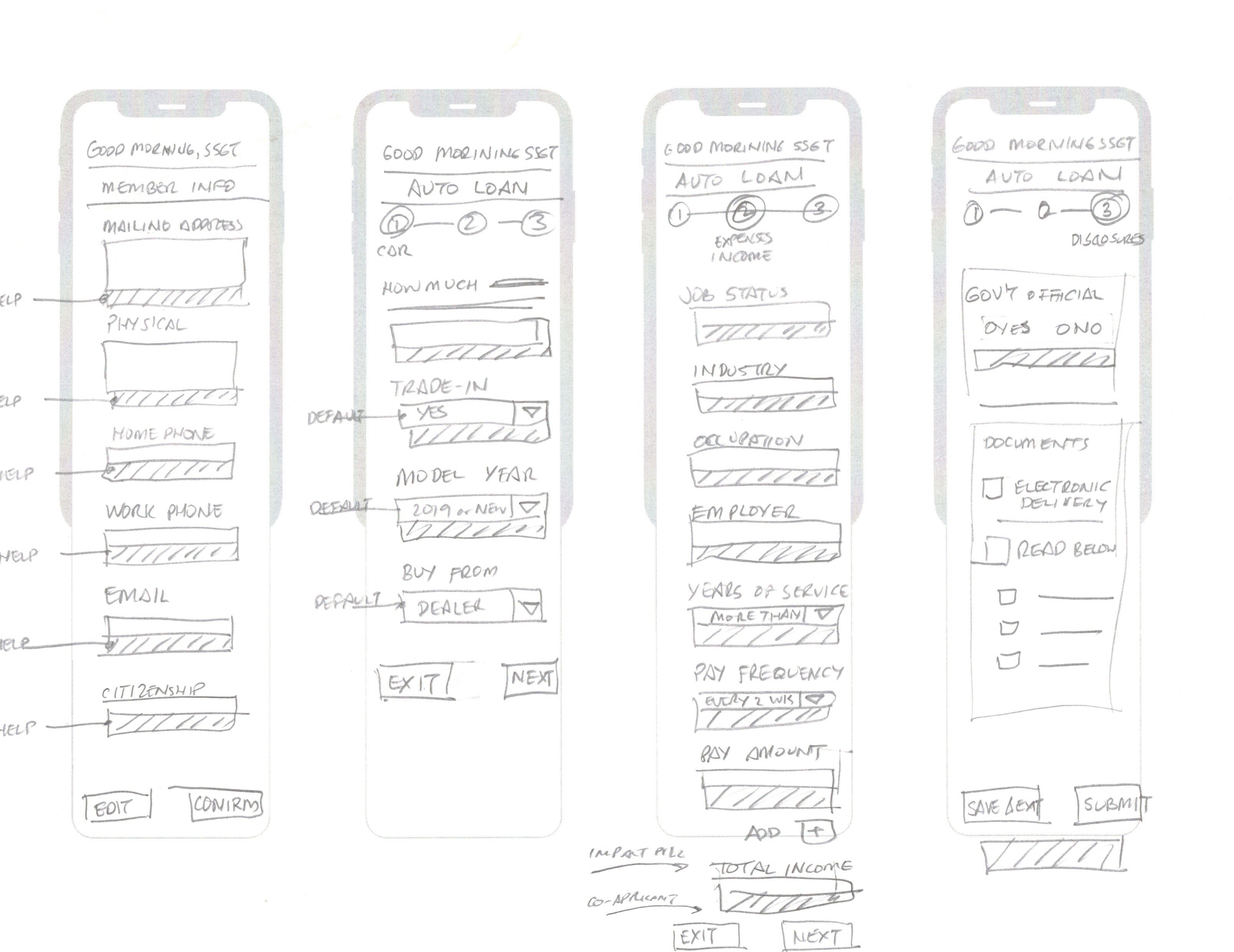

- Information chunking the application into similar, manageable units which people can easily process

- Provide contextual and reference educational opportunities

- Align the user interface to the brand Design System

My Role

UX | UI | IA | Management

- One of two designers creating and testing solutions

Result

- Users are confident in the car loan process

- Users understand the car loan process and the steps involved

- Increase in percent of completed self-service loan applications

- Branded and coherent user experience.

- Increase percent of completed self-service loan applications.

Solution & Artifacts

Research & Process

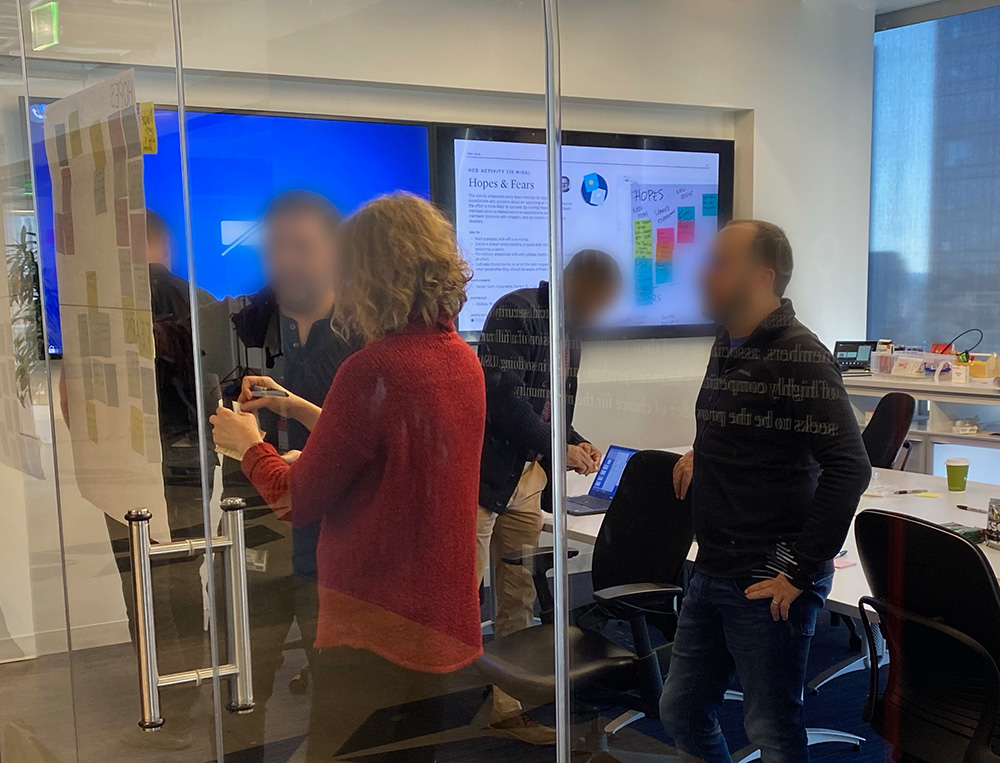

Stakeholder Workshop

Stakeholder Workshop

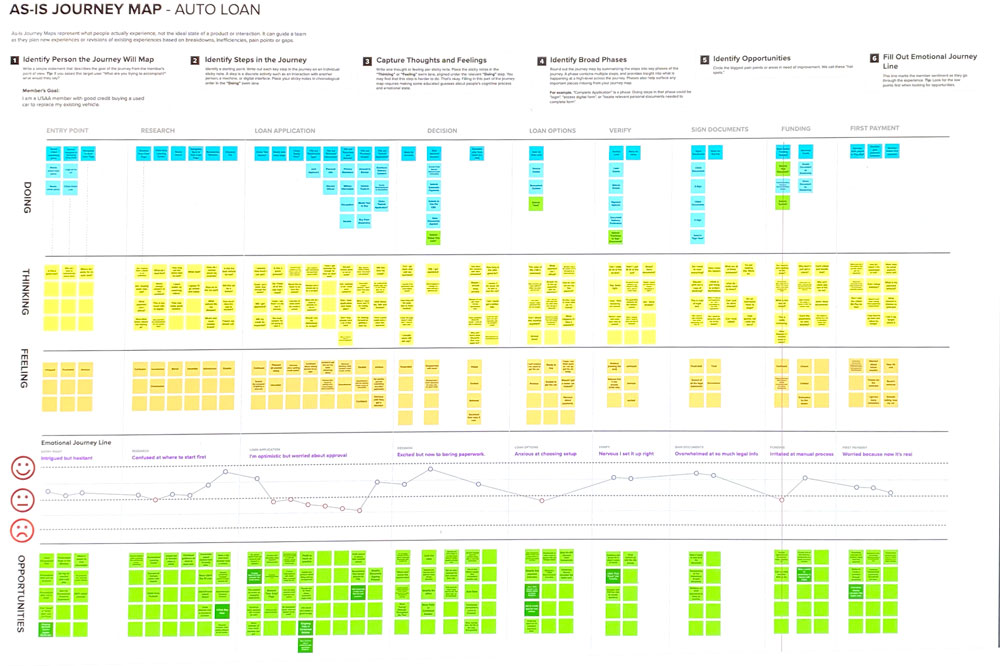

User Journey Map

User Journey Map

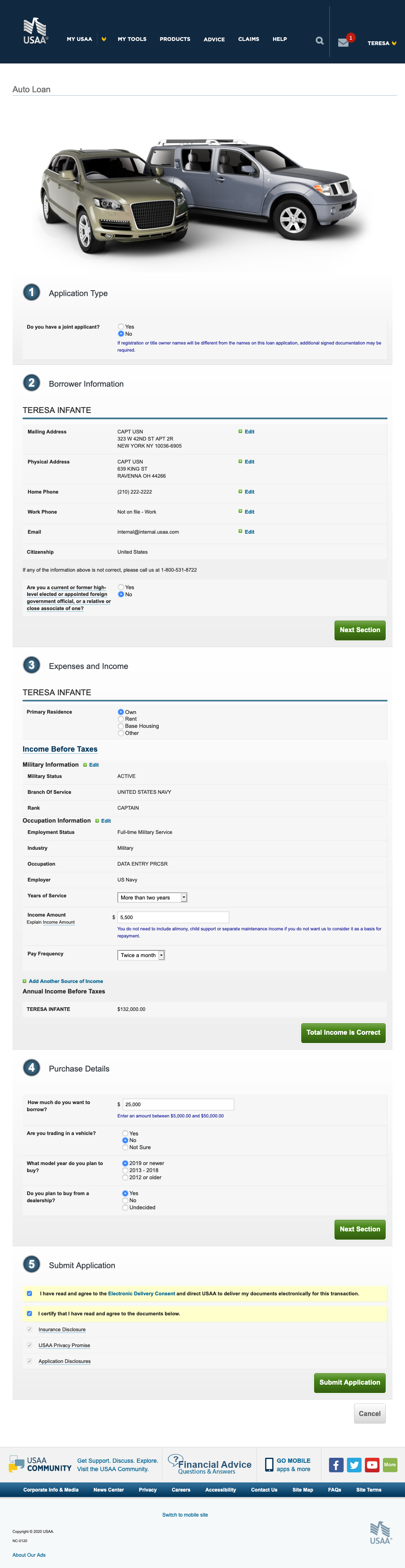

As-Is Car Loan Application

As-Is Car Loan Application

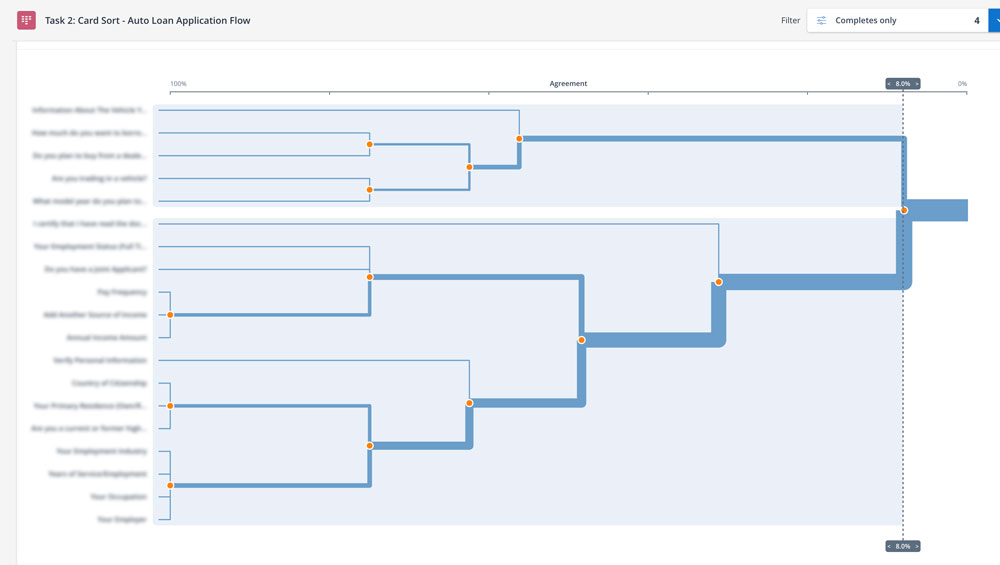

Card Sort to Chunk Application Fields

Card Sort to Chunk Application Fields

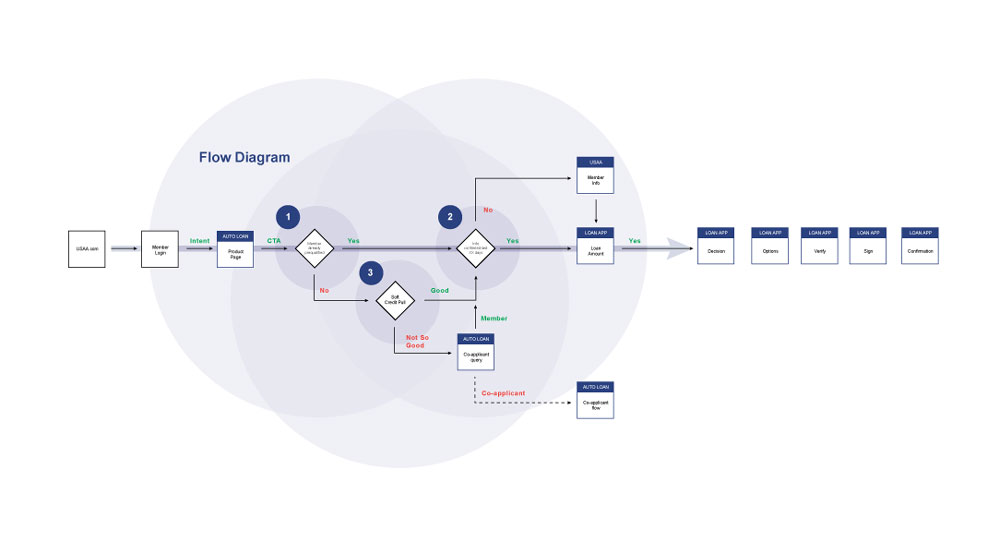

Efficiency Concept

Efficiency Concept

Help Concept

Help Concept

Help Concept Wireframe

Help Concept Wireframe

Help Concept Animation

Help Concept Animation